Industries, such as construction, manufacturing, transportation, or waste hauling, that rely on revenue generating equipment are very capital intensive and have a lot of equity tied up in that equipment. Refinancing the equipment can have major benefits to the cash flow and business operations of a company. The top five reasons to refinance equipment are:

- Lower monthly payments

- Avoid balloon payments

- Exercise purchase options on leased equipment

- Receive cash (turn that equipment equity into cash)

- Consolidate debt

1. lower monthly payments

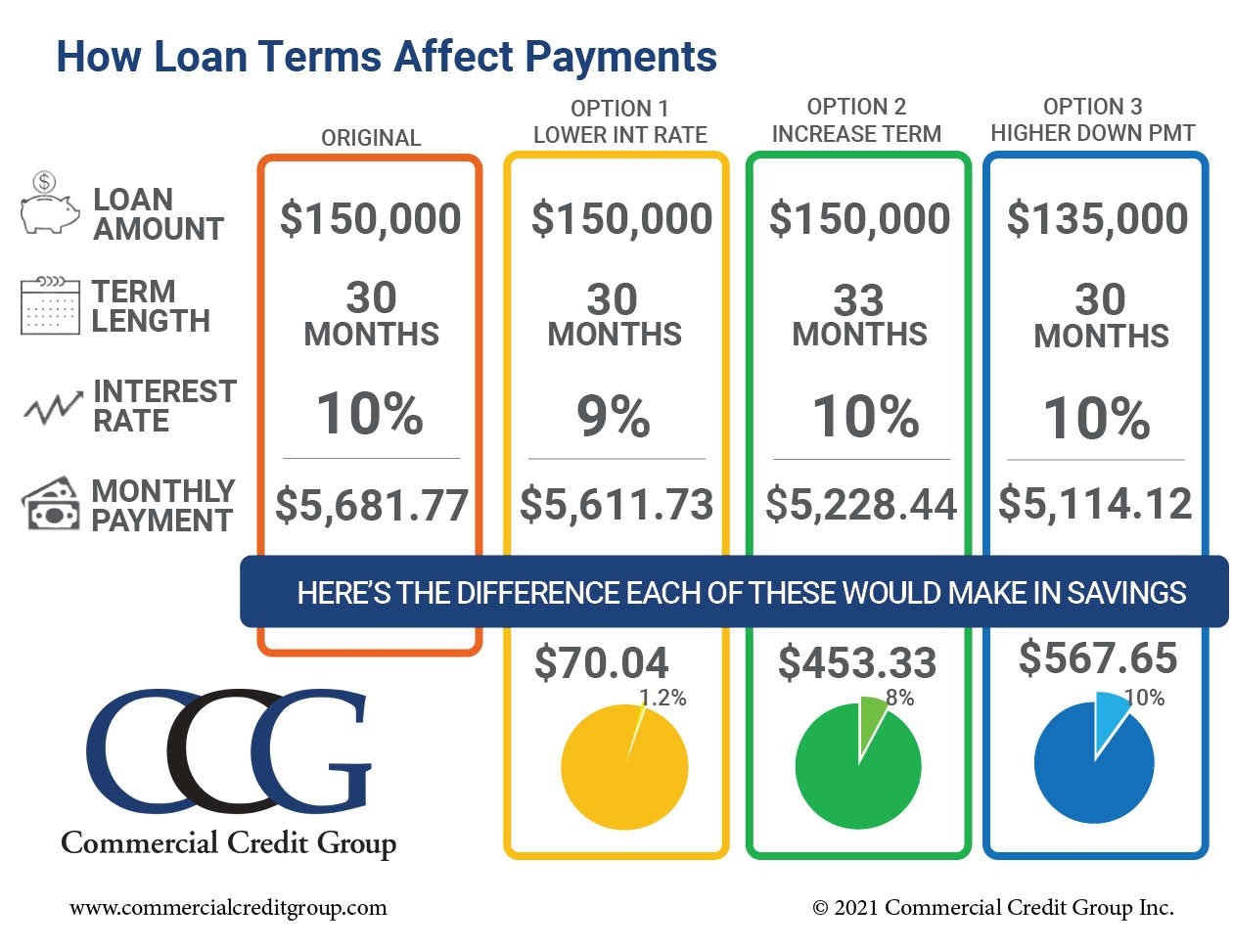

Equipment refinancing can often result in lower monthly payments, thereby improving cash flow. This is most often achieved by extending the term of the existing loan and spreading payments over a longer period of time.

2. avoid balloon payments

Refinancing can be used to avoid an end-of-term balloon payment. Refinancing prior to a balloon payment pays off the original loan with a new loan and provides more manageable monthly payments.

3. Exercise purchase options

Equipment leases have purchase options due at the end of the term of the initial lease. Many equipment lessors will not finance the purchase option despite the lessee making all of the payments as agreed. Refinancing used in this regard can effectively write a new loan using the leased equipment as collateral and the proceeds of this loan will pay off the residual. The end result being that the equipment is now owned and simply financed.

4. receive cash

Machinery and equipment are capital assets, meaning they contain equity against which a lender may be willing to loan money. A knowledgeable lender that understands the equipment and its value can refinance equipment that is fully paid for or is currently being financed on another loan.

Using equipment that has equity on a loan can result in the borrower receiving working capital, from the proceeds of the loan. The cash can then be used for multiple reasons including to:

- Make purchases – new equipment, raw materials, real estate, building improvements, etc.

- Pay off other loans or obligations – taxes, lines of credit, etc.

- Simply have a cash cushion for when it's needed

5. consolidate debt

Debt consolidation simply means taking multiple loans and refinancing them into one loan with one monthly payment. In the case of equipment financing, the consolidation lender evaluates the equity in the equipment to determine the amount that can be refinanced and used to pay off existing loans.

If the loans being consolidated are all equipment loans, the lender combines the loans into one obligation, pays off the original lenders, and provides one loan with one monthly payment to the company.

If the loans being consolidated include equipment loans and other loans (merchant cash advance [MCA], other business loans, etc.), the lender will determine if there is enough equity in the equipment to provide cash from the loan proceeds to pay off the additional loan obligations. If there is enough equity, the loan amount will allow for cash proceeds that can be used to pay off the additional loans.

Debt consolidation is especially helpful if the loans being paid off have higher interest rates or unfavorable payment terms (in the case of an MCA) or balloon payments. It also simplifies bookkeeping by reducing the number of loan obligations and payments that need to be made.

Multiple Benefits are Possible

It is possible to achieve multiple benefits through equipment refinancing. One of the keys is to understand the amount of equity in the existing equipment. A lender that specializes in your industry and has equipment knowledge can help you leverage the equity in your equipment and enhance your borrowing power.

If you are trying to reduce monthly payments, avoid a balloon payment, have a lease residual coming due, need cash, want to consolidate debt (or any combination of these), complete this form or give us a call at 1-855-893-0700 to get started.

Or, download our Refinance Checklist to learn more or watch the video.