Reluctant to buy new equipment because of existing debt load? We get that. It’s not good business to overextend yourself. But sometimes it’s possible to improve cash flow, consolidate existing debt, combine it with a new purchase AND still reduce monthly payments.

First, let’s get started with the basics:

1. What is Cash Flow?

Cash flow is the amount of cash coming into a business and the amount going out at any given time. It is important for a company to prepare a cash flow statement to identify the categories and sources of incoming and outgoing cash. Typically, a cash flow report is completed monthly and should include daily operating expenses, investments for business expansion and other finances.

To be cash flow positive, a business must be able to cover expenses with the money collected from sales and receivables, or with available working capital. It is possible to have a profitable business and have negative cash flow if the timing of your cash collection is longer than what is needed for expenditures.

Sometimes businesses experience seasonality, economic fluctuations or business opportunities and challenges that make them cash flow negative. These circumstances are often uncontrollable, but owners should prepare for these business disruptions in order to succeed long term. Staying cash flow positive should always be a goal for any company and consistent trends of negative cash flow can have a negative impact on your business.

2. What is Debt Consolidation?

Debt consolidation is the process of replacing multiple loans with one single loan. This reduces the number of creditors you are paying by consolidating your debts into one payment through a single lender. Oftentimes companies are overleveraged with different sources of debt, and consolidation can help with debt management and potentially reduce monthly payments and improve cash flow.

Debt consolidation provides several benefits:

- Enables the purchase of needed equipment to grow the business

- Consolidates debt service into one convenient payment

- Potentially improves monthly cash flow

So how exactly does debt consolidation improve cash flow?

How Debt Consolidation Can Improve Cash Flow

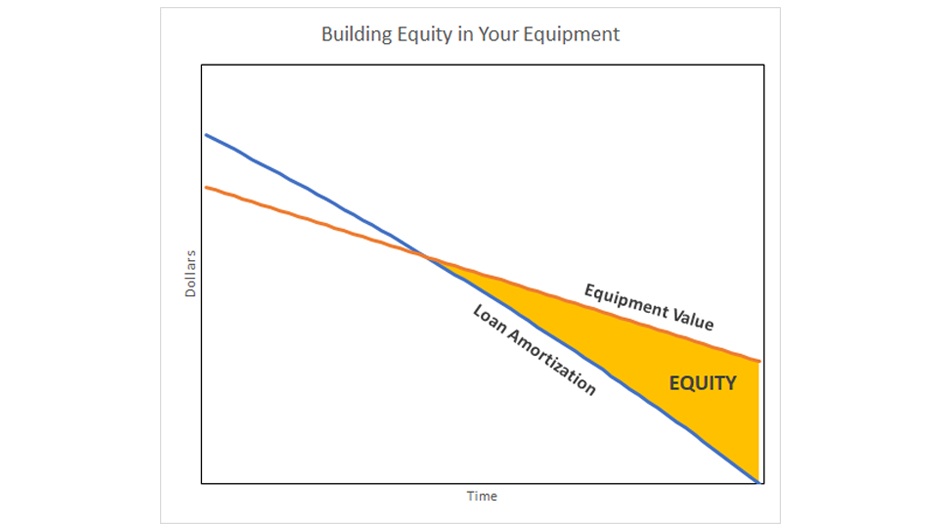

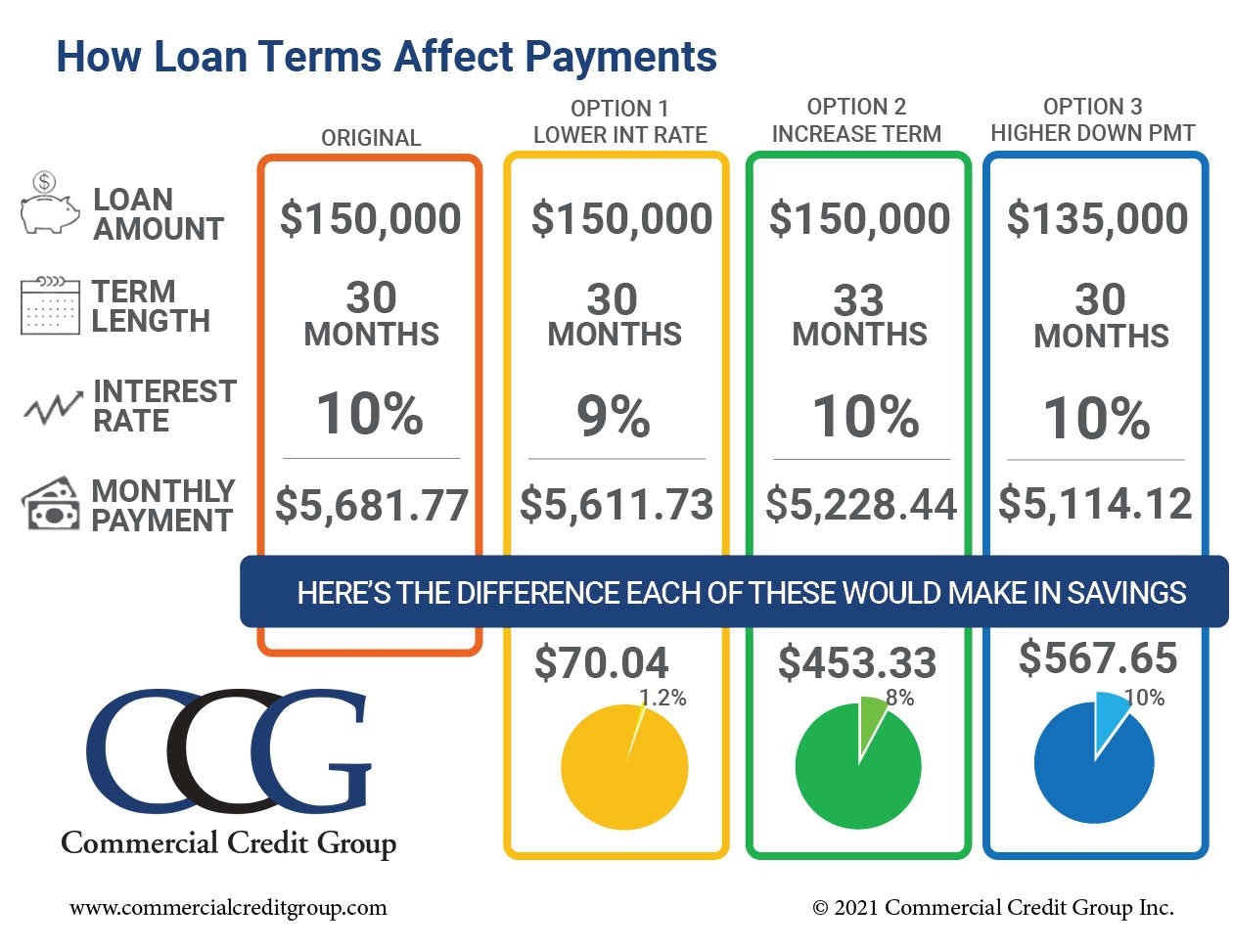

When consolidating debt with one lender, that lender may give the option to extend the term on a loan, thereby reducing the total monthly payment. Paying less each month can increase cash flow and allow more flexibility with seasonality or opportunities for business expansion.

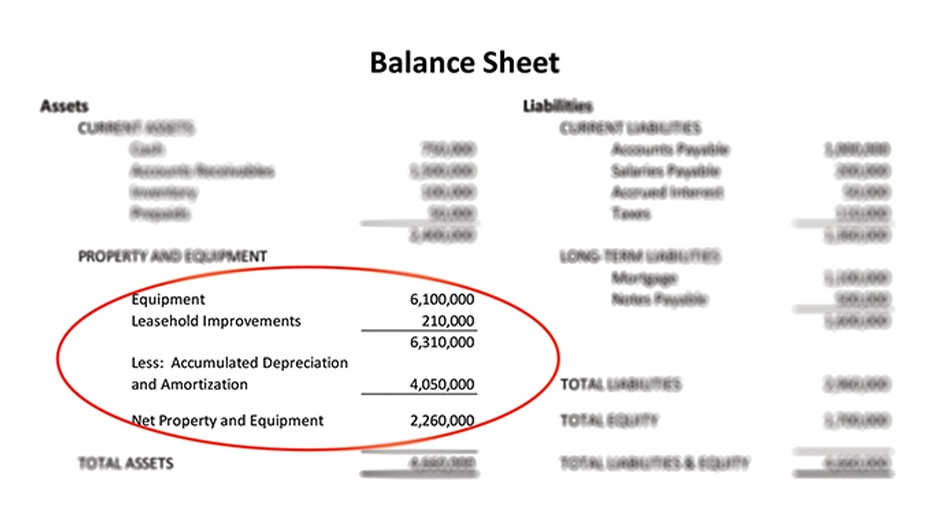

If debt consolidation sounds like the right decision, it is important to work with a lender that understands the industry you are in and the equipment you own or want to purchase. Your point of contact at a bank, for example, may not understand the market value of your equipment. They may only take the book value into consideration, without considering the accumulated equity. Nor will they have the flexibility to work with you during times of business disruption.

At Commercial Credit Group (CCG), we can help because we understand equipment, and we understand equipment financing. We know what to look for when evaluating equipment and the financial circumstances of our customers. We’re used to helping companies obtain the equipment and financing that fit their needs and help grow their businesses.

Learn more about debt consolidation or explore additional financing options at CCG.