What We Learned from 2020 - A Year in Review

The year of 2020 was certainly one to remember. Although many would like to forget about it and leave it all behind, there are things that can be learned from what happened. Here is what we learned....

Most companies don’t have crisis plans in place

While the long initial lockdown of 2020 was something no one could have foreseen, it became obvious that many companies and individuals struggled to adjust and survive. Many companies did not have contingency plans and were completely unprepared. They didn’t have infrastructure and equipment to accommodate work-from-home orders. They didn’t have contingency plans or back-up sources for raw materials, inventory or supplies. They didn’t have readily available cash reserves to tide them over, meet payroll or pay suppliers.

Much of the panic associated with the initial lockdown could have been avoided or mitigated if companies already had crisis plans developed. Crisis plans can be implemented in a variety of situations: medical emergencies; natural disaster, weather-related or Act of God emergencies; cyber-security attacks; incapacitation of company leaders; loss of critical customers or employees and more. Some of the specific action items will change depending on the situation but having a starting point for discussion and action is critical.

LESSON ONE:

Develop a crisis plan for reference in any emergency situation. Discuss various situations and scenarios with key leadership members. Establish basic action and communication steps and share with responsible parties.

MANY companies ARE NOT FINANCIALLY PREPARED FOR EMERGENCIES

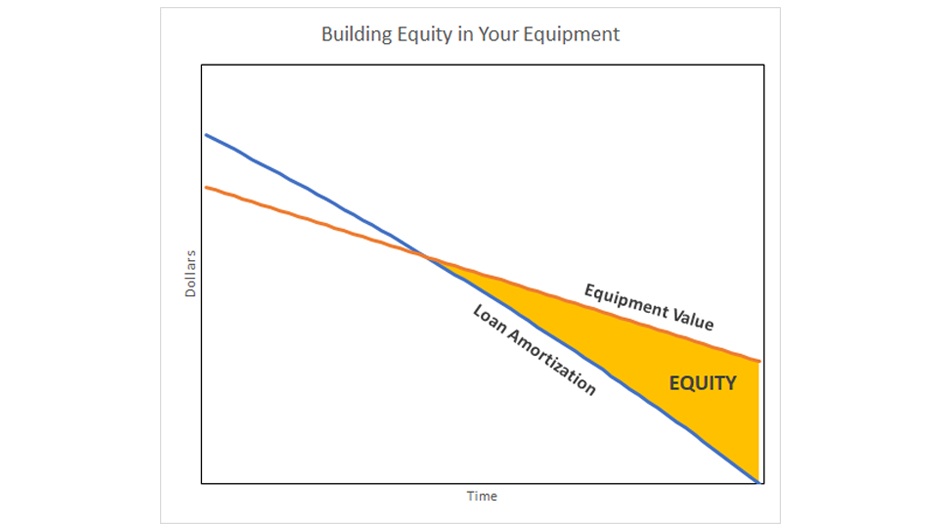

Whether in crisis or not, many companies don’t have the ability or resources to keep large cash reserves on hand. In lieu of that, it’s prudent to have more than one financial partner with whom you work. Diversification of lending partners is helpful, especially if one of the partners intimately understands your business, industry and equipment and can act and render credit decisions quickly and under uncertain macro conditions.

Because most companies are not financially prepared for crisis, many jumped on the first lifelines they were thrown – Paycheck Protection Program (PPP) and loan extensions. Because the PPP money was offered on a first come, first serve basis and no one knew how long the money would be available, companies rushed to apply for the loans and banks were inundated with applications. This initial scramble overwhelmed the financial institutions and caused processing delays and confusion. Further the use of the PPP proceeds came with conditions and restrictions especially if their full benefit could be realized. This left a significant need for additional sources of capital.

LESSON TWO:

Make sure to have more than one financial partner that intimately understands your business, industry and equipment and can provide credit quickly and efficiently even in turbulent times.

some industries truly are essential

The pandemic made it apparent that the industries served by Commercial Credit Group (CCG) are essential to the country’s economy.

The transportation industry has proven to be the lifeblood of the nation. The logistics people and truckers are the ones that enabled the stores to restock necessary items, like food, toilet paper, flour, and inventory for your business. They literally kept the economy running.

The manufacturing industry, despite raw material disruptions, is keeping a portion of the population employed, while ensuring that we still had access to essential products and technology including especially, personal protective equipment (PPE) and ventilators.

In most areas of the country, construction continued, fueled by the booming housing market, road and bridge repair, accommodations for social distancing and home improvements, even swimming pool installations. And while construction of office buildings and restaurants has slowed, the industry continues to thrive, despite labor and material disruptions and delays.

Where would we be without the waste industry? No matter the working environment, Americans generate a lot of waste and recycling. Garbage pickup continued uninterrupted in most cases, although with greater emphasis on residential pickups and reduced need for some commercial waste collection.

LESSON THREE:

The four core industries CCG serves are essential to the nation’s economic well-being.

we learned to communicate and conduct business differently

Because travel was restricted, and many companies had personnel working from home where possible, unscheduled drop-in cold calls and face-to-face meetings came to an abrupt halt. Many people were left wondering how they would do their jobs, help their customers and meet their sales quotas. Thank goodness for technology!

Adoption of technology was greatly accelerated due to the pandemic. Remote work-from-home computer stations to video chats, calls and meetings allowed businesses to a way to keep in touch with workers, clients and prospects.

The companies that have survived and thrived are those that were able to accommodate, adapt and diversify. At CCG, we accelerated the implementation of esignatures for documentation. The functionality had been in the testing phase when the lockdowns began, but we fast-tracked the roll-out to continue to service customers during the pandemic without disruption, and ultimately speeding up the funding process.

Of course, our customers adapted as well:

- Manufacturers shifted production to accommodate the need for PPE, ventilator parts and other necessary medical equipment

- Diversified waste haulers were able to shift equipment and employees from the slowing commercial segment to the increasing residential sector

- Trucking companies shifted routes and resources

LESSON FOUR:

Companies need to have the flexibility and resources to adapt to the changing conditions to continue to serve their customers.

During the entire duration of the pandemic and continuing through today CCG has helped companies by providing equipment financing to overcome the economic and personal obstacles created by COVID and allowed them to take advantage of the opportunities which the economic disruption created. While other lenders have limited their lending and tightened their credit profiles, CCG continues to be there for our customers. In fact, CCG experienced record new business originations in 2020.

As we head into 2021, the COVID crisis is not over. There are still obstacles to hurdle and challenges to overcome. And let’s face it, nothing is certain, so in essence, we’re always facing times of uncertainty. The best we can do is plan for the future, be as prepared as possible and learn from the past.

"Ruminating about the past will get you nowhere. So go ahead and learn from the past whatever you can, and then put it behind you. Remember, there is nothing you can do to change it, but you can use its lessons to improve your future." - Abraham J. Twerski

Read Part 2 of this "Lessons Learned" blog post, where we discuss the specific challenges and changes faced by the construction, manufacturing, transportation and waste industries.

Subscribe to Our Blog

Want to know when our blog has been updated with new posts?

Complete our short form and we’ll make sure you are informed.

Fill out our short form to subscribe