Company Type:

-- Industrial Climate Control Solutions

Location:

-- Southwest

Background:

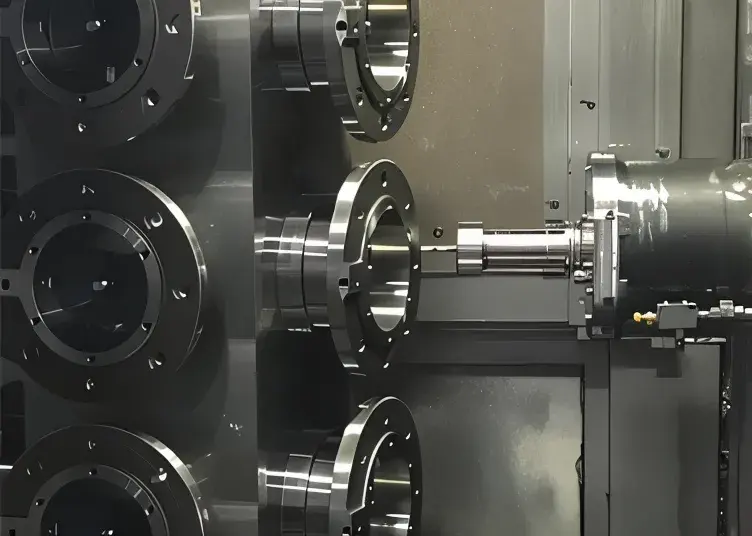

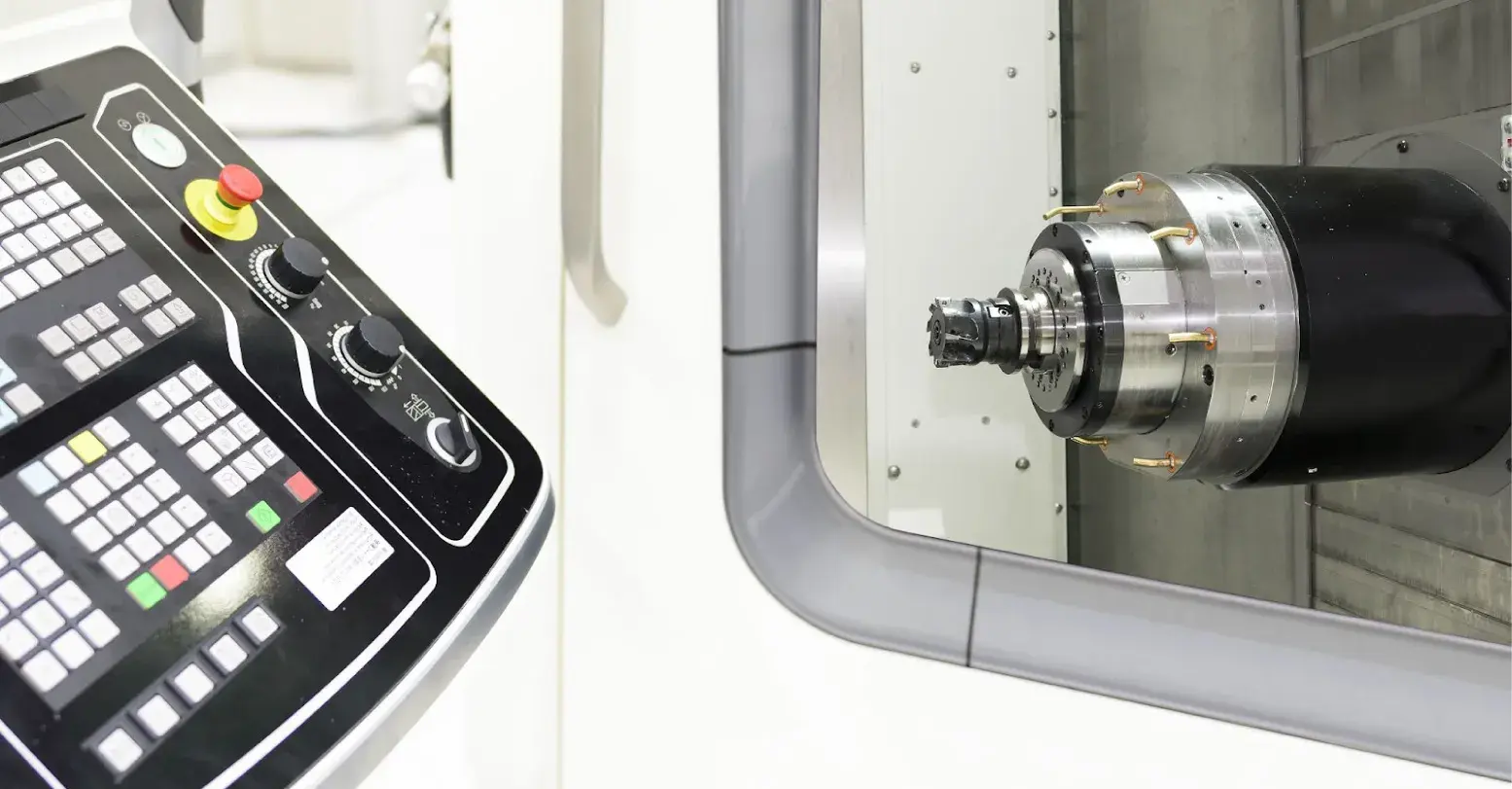

This industrial climate controls company was established in 2013 and designs environmental control systems and custom projects for commercial buildings.

They needed to modernize their facility and add equipment to complete their strategic plan of insourcing critical processes of their production. They also had a plan to expand into field services for their products.

The size of this endeavor presented a challenge as to how best to finance the new machinery they required but also secure working capital to make the related facilities improvements and manage their existing debt service.

The company needed to purchase seven new pieces of equipment from four different vendors and receive working capital for facility improvements. They also needed to find a finance company that understood their industry and was willing to consolidate all of the new equipment purchases and working capital into one monthly payment.

Situation

Manufacturer Needs Machines From Multiple Vendors Plus Additional Capital

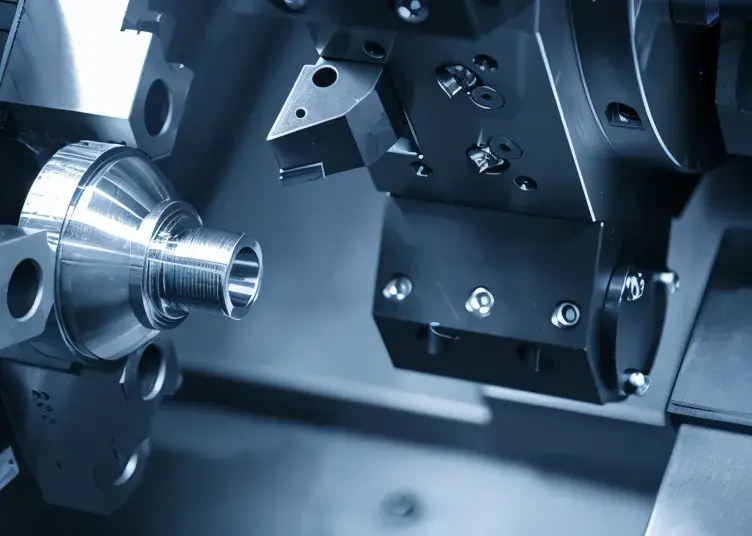

This company desired to finance 7 pieces of new equipment from 4 vendors, payoff 2 existing loans and be reimbursed for the $20,000 that they had already put down as a deposit on the new machines. They were also in the process of selecting accessories for these machines and identifying the needed facilities improvements but did not have enough working capital available.

The total amount needed to refinance the existing equipment, purchase new machines and obtain working capital was $700,000. Manufacturers Capital had a strong relationship with this customer and was able to assist them through this highly complex transaction.

Solution

Manufacturers Capital Has The Experience To Finance Machines And Fund Complex Transactions That Most Other Lenders Cannot

Manufacturers Capital was able to work with the customer to structure equipment financing to accomplish the company’s goals. The company was able to acquire the new equipment, consolidate their existing loans and receive the necessary working capital. The customer now has a single loan payment on terms that enabled them to expand their business and manage their cash flow. This otherwise complex transaction was closed as a result of partnering with a finance company that understood the company’s business and the equipment they operated.

The complete transaction included:

- Refinancing 2 laser cutting systems, worth $470,000, that they already owned

- Purchasing 7 new powder coating systems for $175,000

- Providing $54,000 working capital for facility improvements and smaller equipment purchases