Company Type:

-- Contract Machining and Fabrication

Location:

-- Northwest

Background:

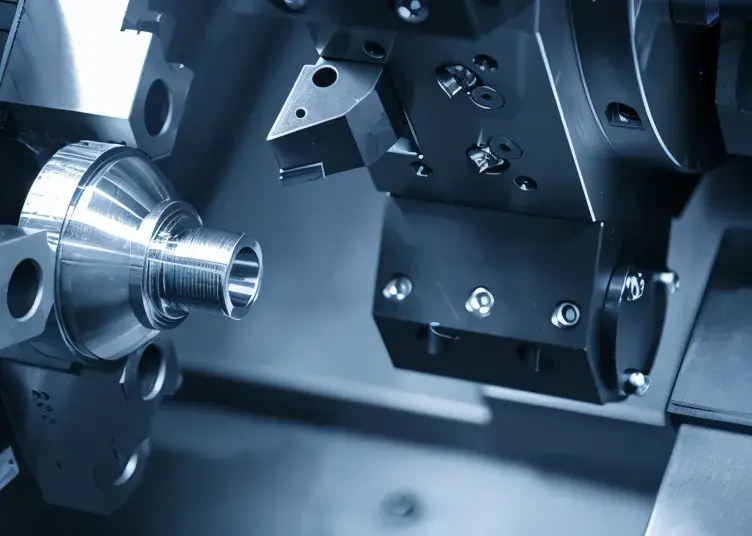

A multi-million-dollar company specializing in metal fabricating and welding of complex parts for the aerospace industry had a new three-year contract that required the purchase of additional equipment.

A contract machine shop was on a tight deadline to purchase a new machine to fulfill a new contract. By financing the new machine and refinancing existing equipment, they got the new machine and saved on their monthly loan payments.

Situation

A 30 Year Old Company Was in a Time Crunch to Purchase New Machine Before Their First Parts Deadline

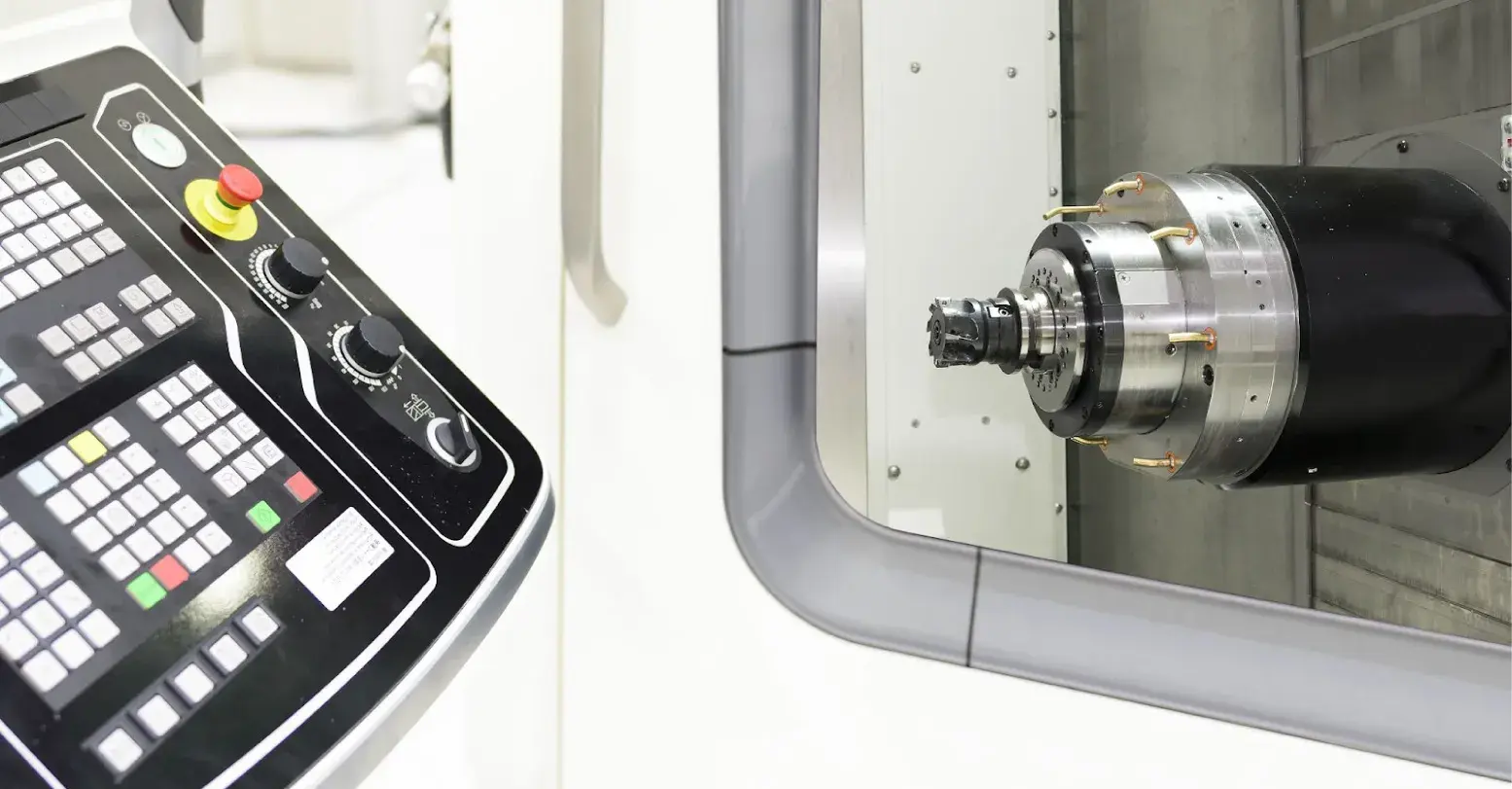

A successful commercial parts manufacturer, and existing customer of Manufacturers Capital, needed to purchase a new horizontal machining center in order to take on a new three-year contract for a client. The customer called their Manufacturers Capital representative to discuss their current situation, vision for their company, and to explore their options for financing the new machine.

The customer explained that they needed a decision quickly so they could get the machine in place and operational in order to meet the first parts order deadline. The Manufacturers Capital representative, familiar with the company’s existing business and existing equipment, asked about their current debt load and cash flow situation. He found there might be opportunity to refinance existing equipment along with financing the new machine resulting in a minimal increase to monthly cash outlay.

Solution

Refinancing Machinery Loans Helps Manufacturer Lower Monthly Cash Outlay

The purchase price of the new horizontal machining center was $750,000 and payments on this machine would be approximately $16,000 per month. The customer was already paying approximately $29,000 a month on existing equipment loans through multiple lenders. Adding the new payment to their existing debt service would cost $45,000 per month.

Manufacturers Capital evaluated the existing equipment for possible refinance to help improve cash flow. They tailored a plan to combine the purchase of the new machining center with a refinance of the existing equipment resulting in a total monthly payment of $37,000 a month. This represented savings of $8,000 per month versus simply purchasing the new machine.

Additionally, Manufacturers Capital structured the loan with a 90-day delay for the first payment. This gave the company time to get the machine installed, operational and generating income before the first payment was due.