TL;DR:

Automation is no longer optional for manufacturers—it’s essential for staying competitive. While upfront costs and financing challenges can slow adoption, creative funding solutions, such as leveraging equity in existing equipment, can unlock the capital needed for robotics, CNC upgrades, and process integration. Manufacturers Capital specializes in helping businesses overcome these hurdles, turning automation plans into reality without overextending cash flow.

Reinvesting in your business can improve your position in the extremely competitive manufacturing industry. While some smaller shops can manage their business with entry level equipment, we are seeing a huge push by companies to automate their operations to improve efficiency, diversify their business and bring in new customers.

2025 Industry Update: Why Automation Still Matters

In today’s competitive landscape, automation isn’t just a way to get ahead; it’s often the only way to stay in the game. A recent industry outlook survey indicates that over 90% of U.S. manufacturers plan to increase investments in technology and automation over the next few years, underscoring that staying competitive now means staying connected, data-driven, and automated. Trade show events across North America continue to reflect this momentum, showcasing innovations in robotics, IoT connectivity, and automation that help manufacturers improve their operations.

Yet for many manufacturers, the path to automation still feels daunting. Whether that be upfront costs, integration challenges, and more, can slow adoption. Meanwhile, global demand for smart CNC solutions and advanced connectivity continues to accelerate, with the CNC market projected to expand steadily through 2029 as precision, flexibility, and digital integration become essential across industries.

As technology advances, the common question many shop owners face is: “How do you take advantage of these innovations without overextending your cash flow?” The answer often involves thinking creatively about how to fund automation, starting with the resources you already possess.

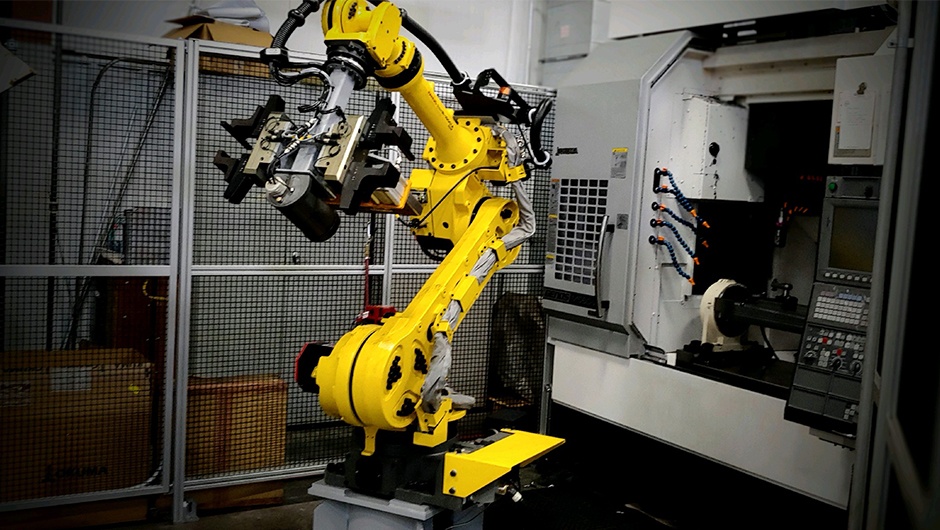

GET A COMPETITIVE ADVANTAGE BY INCORPORATING INDUSTRIAL AUTOMATION

Robotic technology, bar feeders, conveyors and other types of tooling are transforming the industry by offering a means to streamline operations, enhance productivity and reduce costs. However, some business owners receive pushback from their bank when applying for a loan for automation, simply because banks don’t understand the equipment.

Oftentimes lenders are unable to recognize the value in equipment or the advantages of automation in manufacturing. Their approval process is strictly based on a customer’s credit history, personal financials and tax status, which makes investing in automation extremely difficult without a substantial cash down payment.

So, as a manufacturer, how do you get the funding you need to incorporate industrial automation into your shop?

Put Your Existing Equipment to Work

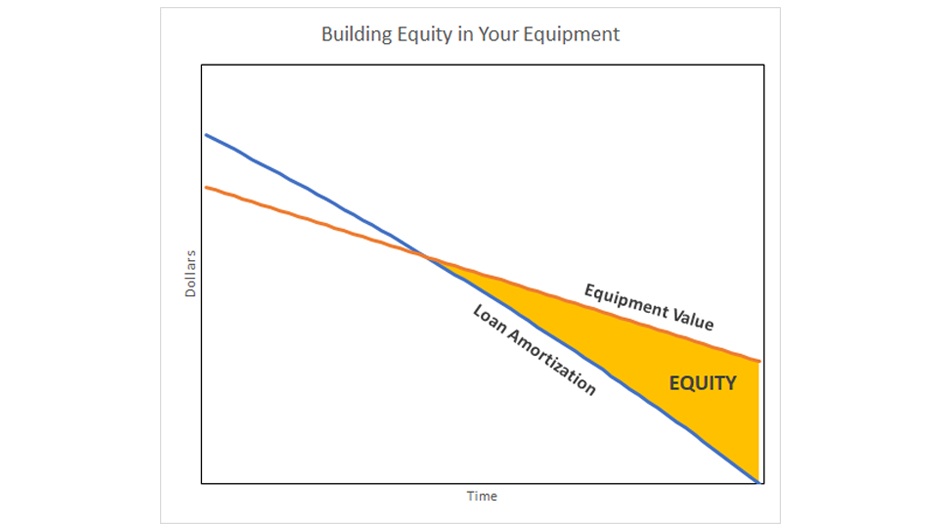

Of course, your equipment is working every day but did you realize that existing equipment can be used to secure new loans and working capital?

- If you own equipment that is free and clear of liens, you can use that equipment to secure a working capital loan. You can then use this cash to purchase all types of automation, including robots, process integration and material handling solutions.

- If you are currently financing multiple pieces of equipment with various lenders, or just one machine that has equity, you may be able to refinance this equipment and tap your equity to generate working capital.

Creative Finance Solutions for Manufacturing Automation - one customer's story

In the heart of Florida’s bustling manufacturing sector, a business owner faced a challenge that threatened to stall his plans for automation. He had secured financing for a massive $500,000 bridge mill—an investment poised to transform his shop—but there was a hitch. The additional tooling required to complete the automation process remained just out of reach. His bank had already said no.

Frustrated but determined, he turned to Manufacturers Capital. Unlike traditional lenders, we don’t think like a bank—we think like problem-solvers. Our team, deeply embedded in the manufacturing industry, understood that automation wasn’t just a luxury; it was the key to growth, efficiency, and a competitive edge.

We sat down with him, not just to talk numbers but to truly understand his business. That’s when we discovered an opportunity hidden in plain sight—his existing machines. Over time, he had built equity across multiple financed machines, spread out among different lenders. Instead of seeing separate debts, we saw potential.

With a creative approach, we refinanced 13 of his machines, paying off 9 completely, and leveraged that built-up equity as collateral for a working capital loan. The result? He had the cash he needed to purchase the automatic tooling, supercharging his productivity. Even better—his monthly payments dropped by $2,000.

It wasn’t just a financing solution; it was a turning point for his business.

At Manufacturers Capital, this is what we do. We find ways to say yes when others say no. If you’re looking for a way to fund your shop’s automation, let’s talk. Your solution might already be within reach.