Company Type:

-- Aerospace Parts Manufacturer

Location:

-- South

Background:

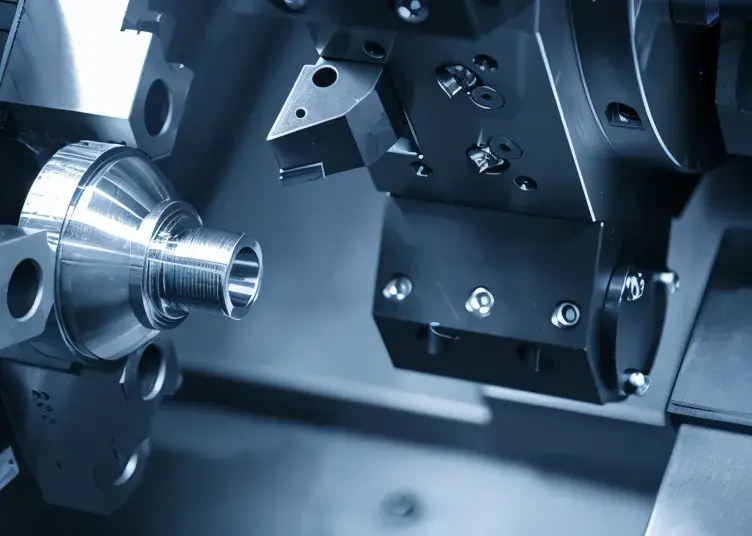

The company was started in the early 2000s and specializes in high-end production of components for the aerospace, appliance, military, recreational vehicles and aftermarket automotive parts.

This company was looking to purchase a new machining center to accommodate growing aerospace work but was already strapped with a sizeable machine loan payment. They needed an alternative to simply adding another loan to the mix to pursue a new business acquisition without increasing monthly payments.

Situation

Manufacturer Needs New Machine For WIP And New Contracts

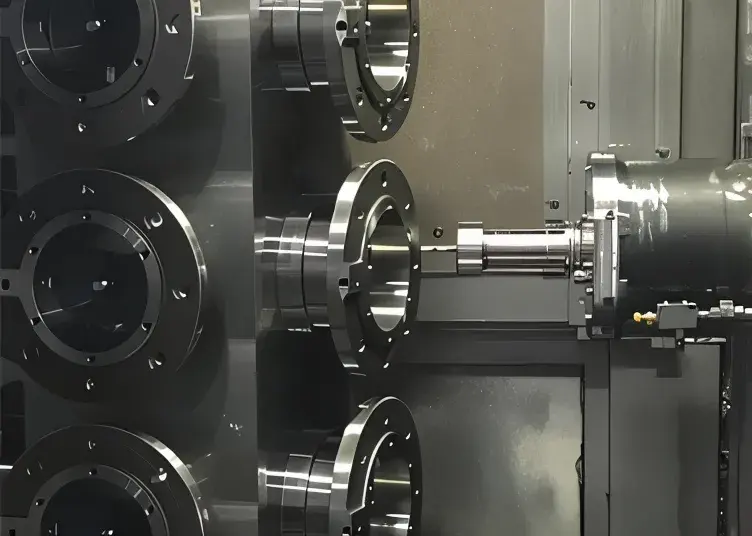

The owner was looking to purchase a $500,000 horizontal machining center to assist with their growing aerospace work and approached Manufacturers Capital for an equipment loan. They already had eight machines financed with six different lenders, totaling $43,000 in payments per month. Simply adding a new loan for the horizontal machining center would bring their total monthly cash outlay to $50,000, increasing monthly payments by $7,000.

Additionally, they wanted to acquire a finishing business, which performed work that they previously outsourced, to round out their business even further. This acquisition would require $600,000 in working capital to purchase new equipment, tooling and automation.

>> Download the case study to learn more about how this manufacturer was able to purchase a new machine and get working capital without increasing monthly payments.

Solution

Consolidating Debt Helps Lower Monthly Payment

After speaking with the customer and touring their facility, a representative from Manufacturers Capital identified an opportunity for them to consolidate their existing debt. This would not only simplify making payments for the owner, who was having to pay 6 lenders each month, but would also provide the company an opportunity to lower their monthly debt service by $6,000, even when adding a new machine purchase.

In this transaction, Manufacturers Capital paid off 8 pieces of their equipment and refinanced 13 additional pieces. This consolidation and refinance resulted in one monthly payment. Since the customer had built up equity in some of those machines, he was able to use that equity as collateral for a working capital loan, which he used to purchase the finishing equipment and other related tooling.

Manufacturers Capital provided this manufacturer with an alternative financing solution that lowered their monthly payments, giving them an opportunity to add the new horizontal without any additional costs and while obtaining cash out for additional automation for their acquisition.